College Fund Proficiency: Unlock the Keys to Save for College

College Fund Proficiency: Unlock the Keys to Save for College

Blog Article

Getting Financial Success in College: Practical Preparation Tips for Trainees

Browsing the monetary obstacles of university can be a challenging job for trainees. As tuition prices proceed to increase and living expenditures accumulate, it is vital for trainees to develop useful preparation methods to attain economic success during their university years. From establishing economic goals to handling trainee loans, there are numerous actions that students can take to guarantee they are on the right track towards a stable economic future. In this discussion, we will certainly discover some practical planning ideas that can aid trainees make notified decisions concerning their financial resources, inevitably enabling them to focus on their scholastic pursuits carefree. So, whether you're a fresher just beginning your college journey or an elderly preparing to enter the workforce, continue reading to find useful understandings that can lead the way to financial success in university and beyond.

Setting Financial Goals

When setting financial objectives, it is important to be realistic and certain. Establishing unrealistic objectives can lead to disappointment and dissuade you from proceeding to work towards monetary success.

In addition, it is crucial to prioritize your financial goals. Determine what is most vital to you and focus on those goals first. Whether it is settling pupil lendings, saving for future costs, or developing a reserve, comprehending your top priorities will assist you allocate your resources successfully.

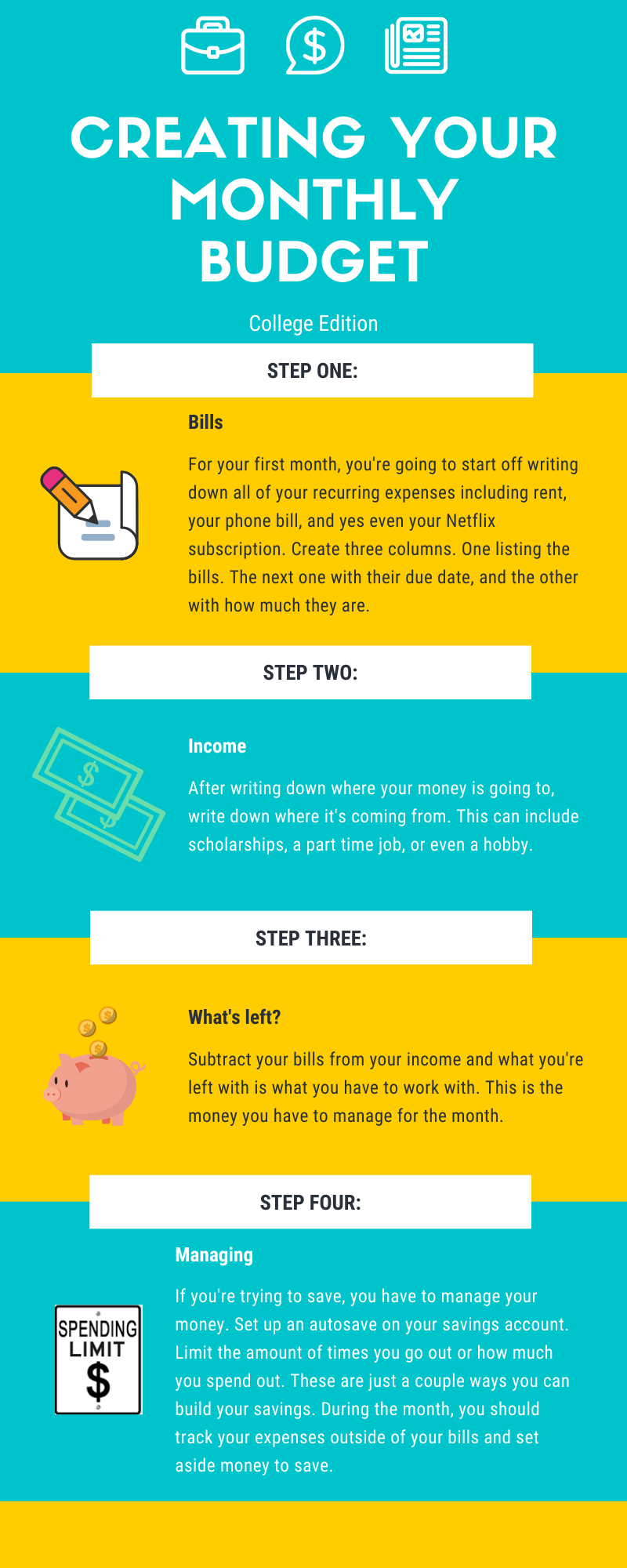

Creating a Budget Plan

When producing a spending plan, begin by identifying your income sources. This might consist of money from a part-time task, scholarships, or monetary aid. Next off, list all your costs, such as tuition fees, books, lease, energies, transportation, and meals. It is very important to be realistic and extensive when estimating your expenses.

Once you have recognized your earnings and expenditures, you can allocate your funds as necessary. Consider alloting a portion of your revenue for emergency situations and financial savings. This will certainly help you build a safeguard for unanticipated expenditures and future objectives.

Review your budget plan consistently and make changes as needed. This will make sure that your budget plan stays reasonable and efficient. Tracking your costs and contrasting them to your budget plan will help you identify locations where you can reduce back or make renovations.

Producing a spending plan is a crucial tool for monetary success in college. It allows you to take control of your financial resources, make educated decisions, and job in the direction of your economic goals.

Maximizing Scholarships and Grants

Making best use of scholarships and gives can dramatically ease the monetary concern of college expenses. Gives and scholarships are forms of economic aid that do not require to be paid off, making them a perfect way for trainees to fund their education. With the rising price of tuition and fees, it is important for trainees to optimize their chances for grants and scholarships.

One means to maximize grants and scholarships is to start the search early. Numerous companies and institutions use scholarships and gives to pupils, yet the application deadlines can be months beforehand. By starting early, students can use and research for as many chances as possible.

In addition, trainees should extensively review the qualification demands for each and every scholarship and grant. Some might have specific criteria, such as academic accomplishments, pop over here community involvement, or specific majors. By understanding the needs, trainees can customize their applications to highlight their staminas and boost their opportunities of obtaining financing.

Moreover, trainees ought to think about getting both nationwide and local scholarships and grants. Regional scholarships often have fewer candidates, raising the possibility of getting an honor. National scholarships, on the other hand, might provide greater financial value. By diversifying their applications, pupils can maximize their chances of protecting economic help (Save for College).

Handling Trainee Car Loans

One essential facet of navigating the economic obligations of college is efficiently managing student financings. To avoid this, pupils need to take a number of steps to effectively handle their trainee car loans.

Most importantly, it is very important to comprehend the terms of the lending. This includes understanding the rates of interest, payment duration, and any type of prospective fees or penalties. By knowing these details, students can plan their funds accordingly and prevent any type of surprises in the future.

Developing a spending plan is one more vital action in managing trainee loans. By tracking revenue and costs, students can make sure that they allocate adequate funds towards car loan payment. This also helps in identifying areas where expenditures can be minimized, enabling more cash to be directed in the direction of funding repayment.

Furthermore, pupils must explore alternatives for car loan forgiveness or settlement support programs. These programs can offer relief for consumers that are battling to repay their financings. It is vital to research study and understand the qualification criteria and needs of these programs to make the most of them.

Last but not least, it is essential to make timely car loan payments. Missing or delaying settlements can bring about added fees, fines, and adverse influence on credit history scores. Establishing automatic payments or reminders can aid make certain that settlements are made in a timely manner.

Saving and Investing Methods

Navigating the financial duties of college, including effectively managing student lendings, sets the foundation for students to apply conserving and investing strategies for long-lasting economic success.

Conserving and spending strategies are important for college students to safeguard their economic future. While it may seem daunting to begin saving and investing while still in university, it is never ever prematurely to begin. By carrying out these approaches beforehand, trainees can make use of the power of compound rate of interest and construct a solid monetary structure.

Among the very first steps in spending and saving is producing a budget plan. This enables students to track their income and expenditures, determine locations where they can cut down, and allot funds in the direction of financial investments and savings. It is very important to establish certain monetary goals and develop a strategy to achieve them.

Another approach is to develop a reserve. This fund functions as a safeguard for unexpected costs or emergency situations, such as clinical costs or cars and truck repair services. By having an emergency fund, trainees can avoid entering into financial obligation and preserve their financial security.

Conclusion

Finally, by setting monetary objectives, creating a budget, optimizing scholarships and find out this here grants, handling pupil fundings, and executing saving and investing strategies, college students can attain monetary success throughout their scholastic years - Save for College. Embracing these sensible planning tips will certainly assist pupils establish liable financial habits and ensure an extra safe and secure future

As tuition costs Visit This Link proceed to increase and living costs add up, it is crucial for trainees to establish sensible preparation techniques to accomplish financial success during their college years. From establishing monetary objectives to taking care of pupil fundings, there are many steps that students can take to guarantee they are on the right track in the direction of a stable economic future.One vital facet of navigating the financial responsibilities of university is effectively managing pupil fundings. To avoid this, trainees ought to take several actions to effectively handle their trainee fundings.

Saving and spending methods are necessary for college students to safeguard their financial future.

Report this page